👇Listen to the Article👇

In retrospect, I should have seen it coming.

In two separate academic works I coauthored - the first Harvard Business Review article about NFTs, and The Everything Token: How NFTs and Web3 Will Transform the Way We Buy, Sell, and Create - we opened with eye-catching dollar signs. The intent was to hook the reader with Beeple’s $69 million sale at Christie’s and the multi-billion dollar valuation of Yuga Labs, then guide them into the deeper promise of blockchain technology.

And to be clear, I still believe in that deeper promise.

But in hindsight, those opening anecdotes didn’t just capture attention, they were a harbinger of how the world of NFTs would play out in the coming years.

This is the first article in a series exploring why NFTs have yet to break through to mainstream adoption and what it will take to get there. And while infrastructure gaps, regulatory headwinds, and venture capital pressures have all played a role, it would be disingenuous to begin anywhere but with the most avoidable peril of all: greed.

Because NFTs aren't just about collectibles or profile pictures. At their core, they represent a new way to manage ownership, access, and identity - tools that could eventually reshape everything from entertainment to education to commerce itself.

And in 2021, as NFTs made headlines with Beeple’s $69 million sale, a multi-billion dollar industry began to take shape with high hopes of delivering on that dream. Artists, programmers, academics, collectors, and celebrities flocked to join the existing crypto community in Web3. Each group found a new frontier - a blend of technology and financial opportunity unlike anything before it.

So how did an innovation meant to empower creators and communities turn into a race for financial upside?

Mint Condition: How NBA Top Shot Sparked the Rush

A logical place to start would be NBA Top Shot. From January to April 2021, the platform exploded from just under 5,000 collectors to over 460,000, a nearly 100x increase in only four months. Participants came to the platform to collect basketball moments like trading cards, whether they pulled them from a digital pack or bought them on the secondary market. The latter part of that, the secondary market, turned out to be a lightning rod.

Big-ticket sales, like a LeBron James “Cosmic” Dunk Moment that sold for $208,000 in February 2021, made headlines. And as attention grew, people rushed to sign up and get in on the action. The only problem? That influx included crypto veterans, casual sports fans, and gamblers hoping to hit it big on a random pack pull. It quickly became clear that many (maybe even most) of them weren’t there for basketball.

On its own, NBA Top Shot is a fantastic product. It provides ownership of thrilling NBA moments, potentially building the next generation of the card market. Because the moments are NFTs, they’re programmable software, which opens up the door to do things you could never do with traditional cards - recognize fandom and provide utility. Teams could identify top fans - they could simply check the blockchain to see who owned the most moments. The platform ran collector challenges, where you could own specific moments or sets to be rewarded with rare moments. They even built raffles for holding certain moments, giving winners real prizes like event tickets and player-signed merchandise.

But with an influx of people who weren’t buying the moments to truly own them, the utility of the NFTs wasn’t about top tier collections or prizes. For many, the primary utility was “number go up” on the price. That, paired with the continued creation of new moments to meet what looked like growing demand, predictably led to a steep price crash. The outcome soured many well-intended users on the platform and the true collectors were left feeling financially hurt.

In many ways, NBA Top Shot set the tone for the NFT market perfectly - a well-designed product with a vision and theoretical product-market-fit that turned into a never-ending cycle of price speculation.

Pixel Vault’s Expanding Universe

Pixel Vault is another case study in this sequence. It started as a company that had a grand vision to fractionalize the ownership of 16 CryptoPunks - one of the most desired digital artifacts. Most people couldn’t afford to buy one, with some Punks sales in the millions. Upon buying a Punks Comic NFT from Pixel Vault, you received two critical things: access to a story by renowned illustrator Chris Wahl, and the right to stake your NFT - locking it up in a contract to earn tokens which represented shares of those 16 Punks.

The innovation there is clear - 10,000 NFTs which digitized fractional ownership of assets, with a staking mechanism that utilized smart contracts, a sort of “vesting” distribution of that gave you more ownership the longer you staked them, and a beautiful token by a great illustrator to represent it all.

But that innovation quickly gave way to complexity, confusion, and unchecked speculation.

Within a year, the Pixel Vault ecosystem had more than 100,000 NFTs, with one often giving holders access to mint the next, fueling speculation through a series of financial mechanics about burning, staking, or holding each one. The ecosystem became so confusing that its top supporters couldn’t even keep up, and instead, people began creating missives about why any given asset was undervalued.

The product had gone from art, fractional ownership, and innovative technology to a speculative casino of blockchain jpgs.

When Profit Replaced Innovation

The story of Pixel Vault repeats across nearly every major NFT brand. What began as experiments in ownership, creativity, and community steadily gave way to trend-chasing and floor price obsession, leaving many Web3 companies unrecognizable from the vision that first brought them to life.

This wasn’t just a matter of bad actors or failed projects, a reductive opinion people often assign at a surface level. The system itself - the reward structures, the culture, and the incentives - prioritized hype over patience, and short-term price action over long-term building. In a world where attention meant liquidity, projects were often pushed to promise more and deliver faster, whether or not it aligned with their original vision.

How Speculation Consumed the Crowd

On the consumer and community side, it wasn’t much different. As prices went up, the competition to get coveted spots to be the first buyers of hyped NFT mints (called allowlist spots) was fierce. Those spots were akin to getting a $120 Nike shoe drop that sells for thousands of dollars on the secondary market, but NFTs moved quicker through digital transactions, and often for even larger profit margins. As an example, Art Gobblers, an NFT collection designed in partnership with Ricky & Morty co-creator Justin Roiland, was a free mint that sold for nearly $25,000 immediately. Today you can get one for around $81.

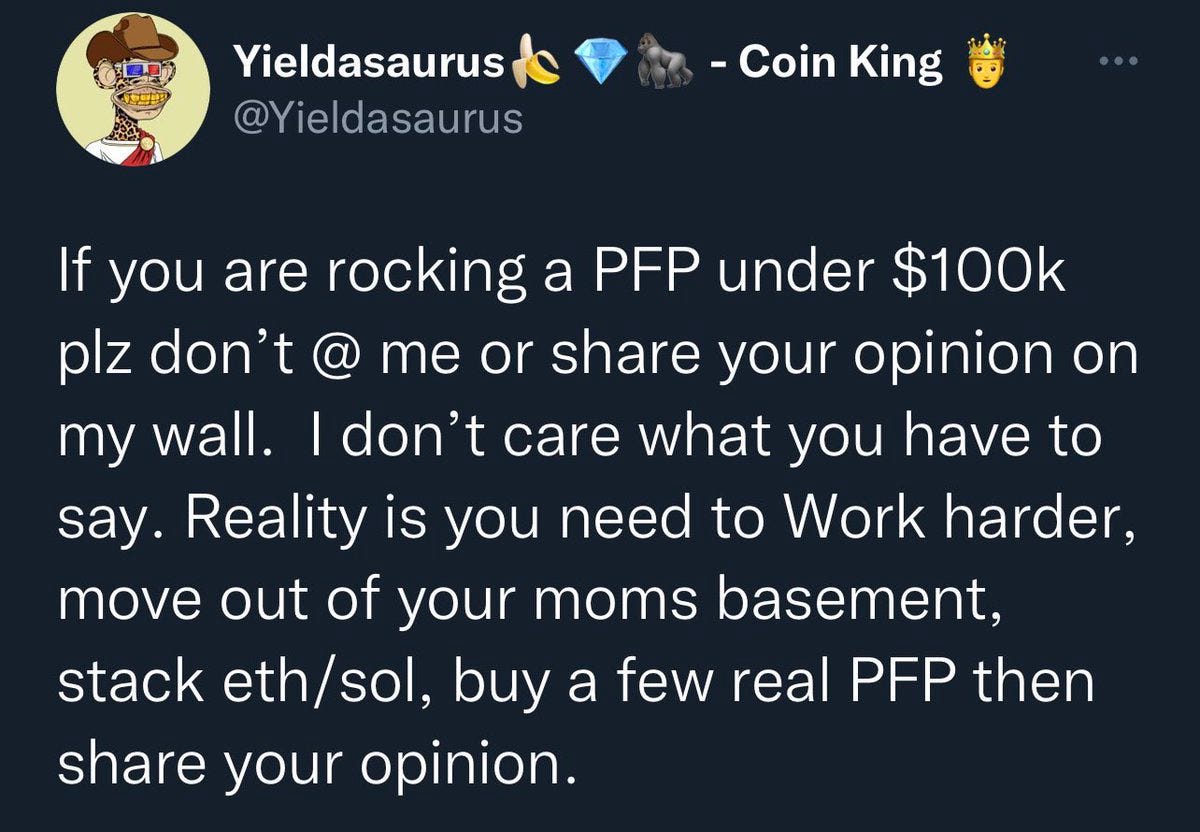

With eyes on quick profits, grinding for allowlist spots became a full-time job, with people faking enthusiasm and jumping through hoops, all for the chance to buy an NFT they could immediately sell to the next person at a higher price. People glued themselves to Twitter sales bots for their favorite projects, looking for high sales to quote with rocket ship emojis and phrases like “to the moon.” Floor price, the lowest cost to acquire an NFT in any given collection, became the only scoreboard that mattered to many people. A team could create fantastic tech or a great experience, but if the floor didn’t move, much of the space considered it a failure. For many, the price of the NFT represented in your profile picture (PFP) was seen as a flex akin to a Rolex or birkin bag. This hit its height when an X user with the handle Yieldasaurus tweeted:

“If you are rocking a PFP under $100K plz don’t @ me or share your opinion on my wall. I don’t care what you have to say. Reality is you need to Work harder, move out of your mom’s basement, stack eth/sol, buy a few real PFP then share your opinion.”

Blurred Lines: Farming, Flipping, and the Death of Royalties

Each financialized mechanic, and the constant reinforcement of those mechanics by the community, pushed the NFT space deeper into hype and speculation. That momentum reached a crescendo with Blur, a marketplace that eliminated royalty fees to promote high-frequency NFT trading, while dangling the promise of a future token airdrop.

Removing royalties stripped a critical profit stream from creators and project teams, undermining long-term sustainability. Meanwhile, the airdrop campaign transformed NFTs into tools for points farming - not because people wanted to own them, but because they wanted exposure to a speculative token that hadn’t even launched yet. People were buying and selling NFTs, often at a loss, in order to earn points, which might later turn into a token, which they hoped others would speculate on. In effect, it wasn’t just speculation on NFTs. It was speculation on speculation - a game with no product, just hope that you could make an even bigger profit around the next corner.

In a system built on short-term wins, long-term value creation becomes structurally disincentivized.

The Promise That Outran the Product

The result was a collapse of credibility. Despite the incredibly powerful use cases, NFTs earned a reputation as little more than a Ponzi scheme or a passing craze akin to Beanie Babies, turning off tech talent, brands, and broader industries that might have otherwise embraced the technology for more meaningful use cases.

Trendlines show that NFT interest hit its peak around the NFT NYC 2021 conference, where extravagant, token-gated parties gave way to public boasts about “generational wealth” on the blockchain.

Web3 participants rushed to secure allowlist spots for hyped mints, tripping over themselves to spend more than $6,000 to mint digital Otherside land, which sold for $25,000 immediately after, and $7,000+ to mint Moonbirds, a pixelated series of owls, that sold for over $60,000 on secondary markets.

By the time Paris Hilton appeared on The Tonight Show with Jimmy Fallon, proudly showing off her Bored Ape, search interest and daily buyers were already falling, as indicated in the graphic below, which highlights NFT search trends, market cap, and daily unique buyers.

Breaking the Cycle: Building Back Ownership Step by Step

Fixing this problem isn’t easy, because many of the financial tools in Web3 (not just NFTs) also unlock real power for users. Gaming NFTs do, in fact, offer a logical solution: true digital ownership of products that can be sold on the open market, something never truly possible before. Membership clubs with deep networks and token-gated events should naturally increase in price as the club’s value proposition improves. And companies with highly sought-after products should reward top fans with token-gated access for high-demand mints.

The problem is also complicated by how it happened - not all at once, but slowly, as well-intentioned builders got caught up in the hype cycle. Just like a week of diet and exercise won’t undo years of bad habits, rebuilding will take time and it will require small, consistent steps. Speculation is a powerful drug, and with an addicted user base, recovery will have to come through a gradual detox.

Furthermore, I’m not here to preach - a good gamble is still a fun time for many, as long as it’s transparent and everyone knows the risks and purpose of the product. And, at times, I myself have participated in some of these games, chasing financial gain.

With that said, here are potential solutions to the complex problem of over-financialization of NFTs.

Flip the Incentive Structure

There’s a fantastic article by Michael Blau, Scott Duke Kominers, and Daren Matsuoka from a16z crypto that outlines multiple potential solutions. I won’t post them all (you can read the full piece here), but the one I like best is the title model.

In this system, each NFT carries a title that only transfers when a title fee is paid. This title fee effectively replaces royalties: instead of a royalty which is a percentage of the sale (this often makes sellers want to duck a five-figure fee for high-end NFTs), the title fee can be a flat or tiered amount. If the fee isn’t paid, the title stays with the seller, who retains the right to call back the NFT at any time.

Another solution is to create a contract that checks whether royalties were paid on the last sale. If not, utility attached to the NFT is locked until the outstanding royalties are paid in full. If the contract confirms royalties were not paid, access to events, airdrops, and new NFTs is restricted. This ultimately incentivizes sellers to respect royalties, since buyers will prioritize NFTs that maintain full future utility.

Both ideas aim to reshape the incentive loop to reward paying royalties rather than avoiding them. The downstream effect is that buyers will gravitate toward NFTs they truly want to own and use, sellers will be motivated to comply with royalties, and with more consistent royalties, project teams will have a more stable treasury to deliver real value back to holders.

Building with Focus and Purpose

Right after I first met my Everything Token coauthor, Scott Duke Kominers, we had a conversation that stuck with me. Scott pointed out something fascinating: community-based NFT brands like Bored Ape Yacht Club or Doodles were incredibly broad in their target markets. In the physical world, most clubs have very specific niches - like golf clubs, chess clubs, or running groups.

Some NFT communities have since evolved more naturally (Bored Ape Yacht Club, for example, has increasingly become a community for active entrepreneurs and builders). But many still remain broad and unfocused. At the time, we chalked that up to a small addressable market: when the space was tiny, brands had to be everything to everyone.

But now the space is bigger and more sophisticated. One way to fix the over-financialization of NFTs is by making the purpose clear. Knowing exactly who your customer is, and just as importantly, who they are not, helps the right people opt in for the right reasons, not just to flip.

Tied closely to that is the need to lay out a clear vision. Speculation in early NFTs thrived on vagueness: teaser tweets, "announcements of announcements," and hype-driven mints. There’s an old adage in Web3 that the most bearish thing for your NFT is actually delivering utility. That mindset has to change.

Digital products are still products. When Apple launches a new device, they don’t lead with speculation or scarcity. They start with a clear user in mind and build with intention - purpose-driven design, thoughtful pricing, and a defined target market. They know why the product exists and who it’s for. NFTs should be treated the same way. NFTs should solve a specific problem or have a clear reason to exist. Start with purpose, then build the product to match.

Own It, Live It: How NFTs Strengthen Brand Loyalty

In The Everything Token, we lay out a framework called the NFT Staircase for successful NFT products, which includes five elements: Ownership, Utility, Identity, Community, and Evolution. You can dive deeper into each element by reading the book, but it’s no accident that 40% of the Staircase - Identity and Community - relates directly to the personal connection users have to a brand.

Digital ownership provides a unique opportunity to turn a concert ticket into a brand anchor, a work badge into a vehicle for discounts and services, or a customer loyalty card into a dynamic membership pass. But to realize that potential, issuers need to double down on recognizing and engaging the communities holding these NFTs - reinforcing the identity of fans, employees, or loyal customers tied to the brand.

To help fix over-financialization, brands (Web3 native and otherwise) must create a true connection. Think about it - someone who rides motorcycles works hard to get a prized Harley-Davidson, not to sell it, but because it’s part of their identity and the motorcycle community is strong. Sneaker collectors chase rare, meaningful pairs, not just for resale value, but because owning them ties them to a cultural moment and a broader community. And while it’s not possible to sell your diploma, even if it were, proud college graduates wouldn’t be looking to sell it because of their university pride and access to alumni advantages provided by the community.

New and existing NFT brands finding ways to recognize community and reinforce identity will help curb the problem of people simply collecting their digital assets for financial gain.

Looking Back, Moving Forward

As I close out Part One of this series, it’s worth noting a few important points.

First, many of the examples discussed here focus on brands that launched in early 2021, simply because they've had the most time to complete a full NFT lifecycle. However, the landscape is evolving.

There are games like Off The Grid that let players mint in-game items as NFTs while keeping the blockchain experience invisible to users. Institutions like the California DMV are exploring ways to anchor driver’s licenses and car titles to the blockchain. And NFT-native brands like VeeFriends are beginning to prove what happens when a clear purpose, strong identity, and active community come together.

The next phase of NFTs won't be built on hype. It will be built on purpose, one company, one user, and one meaningful connection at a time. Because at their best, NFTs aren’t about speculation. They’re about a future where ownership is programmable, portable, and personal. And that future is still very much worth building.

Great read! Rushing to tokenize everything we forgot why we cared in the first place. I miss the awe and wonder of those days. So much potential sacrificed at the altar of floor price and hype, but I am an eternal optimist and still believe we'll get it right eventually.

I like the idea of flipping the incentive structure!